Offshore wind energy on a global scale is still in its infancy. While Northern Europe leads the industry and has made vast leaps in a relatively short time, there’s also great potential in other regions around the world. To find out more about this potential, we spoke to Robert Clover, Research Director at MAKE Consulting.

Can you start by giving us your thoughts on the potential of the offshore wind energy market?

We have strong expectations for the offshore wind industry. Looking at the total wind energy market in 2013, we expect global grid-connected capacity to be 45.2GW. Of this, offshore is expected to contribute a little under 3GW, equivalent to 6.6 percent of total installations. But by 2020, we expect offshore’s share of market to triple to 18 percent of the global market. This is in a period where we expect the global wind energy market (grid-connected MWs) to show a compound annual growth rate of 3.8 percent per annum.

We have strong expectations for the offshore wind industry. Looking at the total wind energy market in 2013, we expect global grid-connected capacity to be 45.2GW. Of this, offshore is expected to contribute a little under 3GW, equivalent to 6.6 percent of total installations. But by 2020, we expect offshore’s share of market to triple to 18 percent of the global market. This is in a period where we expect the global wind energy market (grid-connected MWs) to show a compound annual growth rate of 3.8 percent per annum.

This means we expect the offshore segment to grow by 30.3 percent on average every year, which is a growth rate nearly eight times faster than what we’d expect for the global market.

What do you see as the most important regions outside Northern Europe?

Robert Clover, Research Director at MAKE Consulting

The biggest potential lies in the new markets of the Asia Pacific region, mainly driven by China, but also other countries including Japan, Vietnam, South Korea and Taiwan. We also expect the North America region to take off at some point, but here we’ll have to wait at least two years before we see any developments of significance and these will depend on greater political support in the US than we see today.

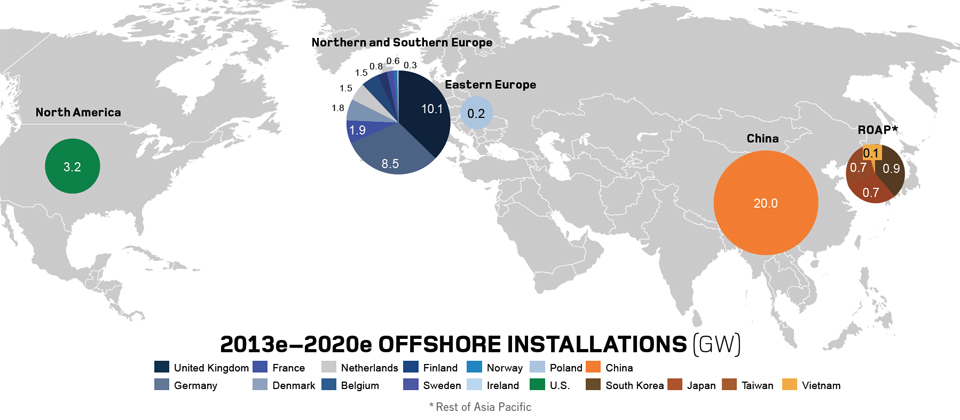

China is the most important region. From 2013 to 2020, we expect China to add 20GW of offshore wind power in a period with estimated global offshore installations of 53GW. So that’s 38 percent of total global offshore grid-connected MWs according to our forecast expectations. It will be comfortably the biggest market outside Europe and, indeed, the strongest single country market. By comparison, Northern Europe as a region will add about 25GW.

Other notable offshore markets include the US, which by 2020 should add about 3.2GW; France around 1.9GW; South Korea 930 MW; Japan 700 MW; and Taiwan 660 MW. There is also potential in Spain, Portugal and North Africa, but there is currently no political willingness to establish offshore markets in these countries.

Why will there be significant growth in the Asia Pacific region?

The emerging markets generally have significant gross domestic product expectations and, therefore, strong power consumption expectations. Based on the local availability of hydrocarbons and renewable sources, different regions have come up with strategies to ensure supply at reasonable cost. China, for example relies on fossil fuels imports. China is looking for ways to provide low carbon power domestically, and wind energy is one of the options. In fact, China’s government has set a target of 5GW of offshore wind capacity by 2015. Likewise, South Korea has set a target of 2GW by 2019 and Taiwan 600 MW by 2020. Generally speaking, government targets and support are significant enablers for growth in all regions outside of Northern Europe.

What is slowing North America down?

Theoretically, there is enough potential offshore wind energy (including the lakes) to power a significant portion of the US power needs; as much as 4,000GW, according to the US Department of Energy! This is mainly because of the significant coastline, much of it with suitable water and wind conditions, close to load centres. But offshore has low political support in the US as there is still the potential to exploit more onshore potential, plus the competing technologies, such as gas, are relatively less expensive on a levelised cost of energy basis (LCOE).

However, we expect the relative cost position to change over time, as gas prices eventually increase and the LCOE for wind comes down. With higher electricity prices and denser populations, the north-eastern states will probably be the first to bring offshore wind projects online. We actually don’t expect to see any demonstration projects until 2015 and there will be limited activity until 2018, but by 2020, we expect the region to have added 2.7GW.

What are the main barriers to growth outside Northern Europe?

Even if there are government targets driving development, these targets need to be backed by local support mechanisms, including subsidies, financing and grid access. Without these mechanisms, it may be difficult to get the investors needed to back projects. There are also some technical challenges for the development of offshore outside of Europe. Offshore installation and operation require specialist expertise and equipment that is not yet well-developed outside of Europe.

In addition, there will be a need to develop the local supply chain supply chain to be able to manufacture specialist components for the offshore market in volume, such as foundations. What this is means is there could be significant opportunity for European offshore specialists (for example, logistics, EPC, manufacturing) to help non-European markets to realise their offshore wind potential.

Like this post? Subscribe now and get notified about new content!